Responsible Investment, Same Tax Rate

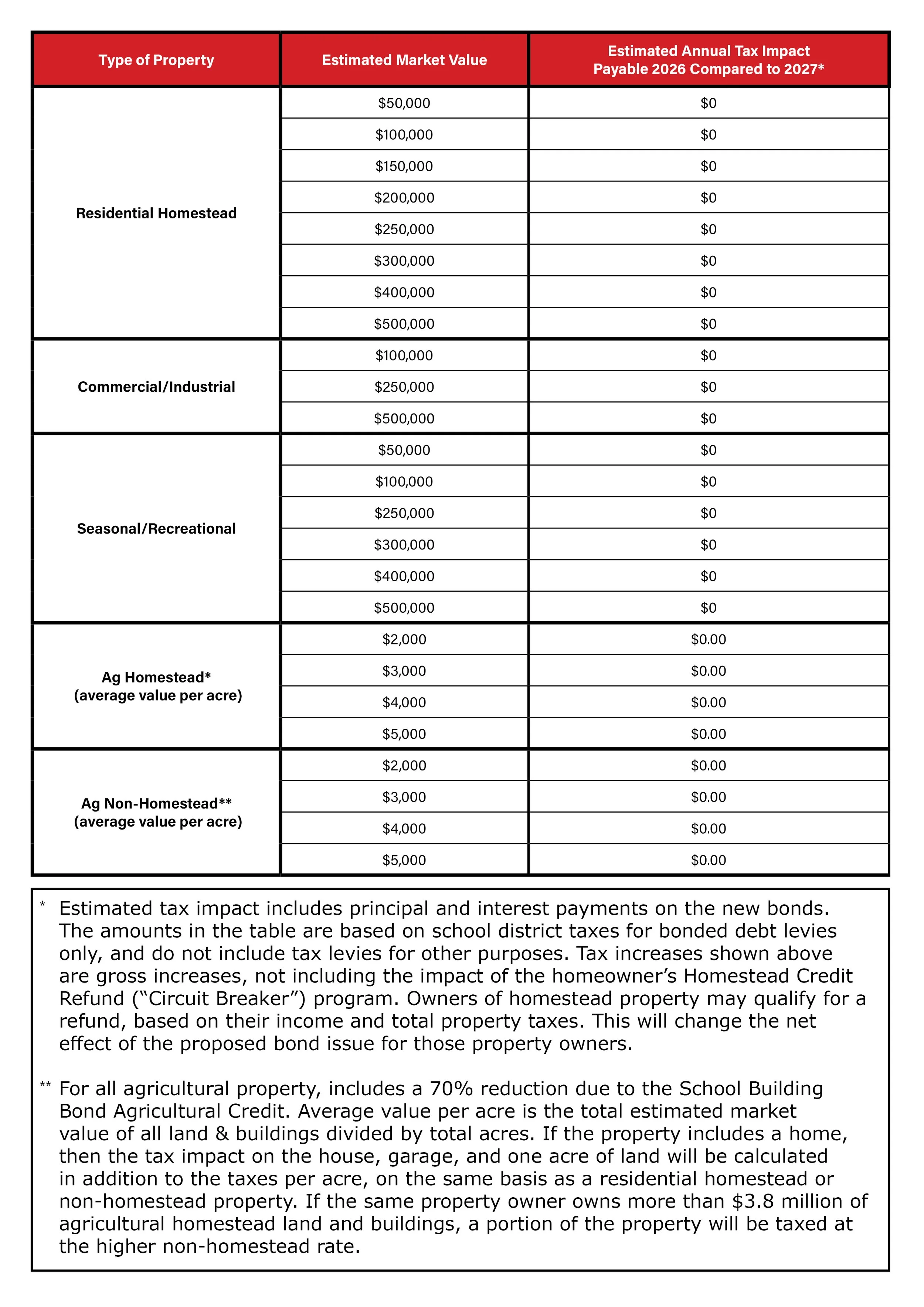

If the referendum is approved, there will be no change to the current school tax rate. As our district finishes paying off old debt, new debt from the referendum will be phased in to replace the old debt being paid off – keeping the tax rate consistent and stable. This neutral tax impact already takes into account all interest payments and state aid.

Use our tax calculator!

Enter your property parcel number or estimated property value to see your estimated tax impact from the referendum.

Please note that your total property taxes may change due to factors beyond the district’s control, such as updated property valuations or adjustments by the city, county, or state.

If the plan is tax-neutral, why does the referendum ballot say that voting “yes” is a vote for a tax increase?

State law requires this ballot language when a school district seeks voter approval to pay for qualifying projects with tax revenue, even if the plan does not require a change to the current tax rate. The annual school tax rate will not change if the referendum is approved.

Questions About The Tax Impact

-

Even though the proposed referendum would not change the school tax rate, you may be eligible for programs that could reduce your property taxes, including:

The Homestead Credit Refund – Minnesota’s largest property tax refund program, received by over 500,000 Minnesota homeowners each year.

The Special One-Year Refund – For property tax increases over 12% and at least $100

A Senior Tax Deferral – Helps residents age 65+ manage property tax bills.

The Renters’ Property Tax Credit – Available to qualifying renters.

The Ag2School Tax Credit – Automatically applies to all agricultural land except the house, garage, and one acre surrounding an agricultural homestead.

-

Qualifying agricultural land will receive an automatic 70% tax credit for taxes paid as a result of the referendum through Minnesota’s Ag2School Tax Credit program. This credit is provided to all agricultural property except the house, garage, and one acre surrounding an agricultural homestead. The credit will remain at 70% for the full term of the referendum bonds. This is not a tax deduction – it is an automatic dollar-for-dollar credit provided automatically by the state, so no application is required.

Approximately 15% of the referendum’s total principal and interest will be covered by the Ag2School credit.

-

Qualifications:

Your total household income is less than $142,490

You were a Minnesota resident for at least half of 2025

You owned and occupied your home as of January 2, 2026

Your property is classified as a homestead

You have no delinquent property taxes

As many as 65% of Minnesota homeowners may qualify if their property taxes exceed 1% to 2.5% of household income. If you qualify, your refund could help offset both your current tax bill and any increases from the referendum, even if you have received a refund in the past.

Refunds are calculated on a sliding scale based on household income and property tax burden. As property taxes increase, so does the refund—up to $3,310 annually. Refunds range from 53% to 88% of the excess amount paid, based on a state formula tied to income.

How to Apply:

Apply using the M1PR form via:

Paper form (available in spring)

Online application (opens in May; deadline is August 15)

If you qualify, your refund will be issued separately from your income tax return. It will not appear on your property tax statement.